How to merge offline customer behaviors with online identities

One of the most common use cases for identity resolution is one of the trickiest: bridging the gap between offline and online interactions.

Earl Lee,

Nate Wardwell

June 30, 2025

|7 minutes

Businesses in industries like retail, food and dining, and hospitality have customers who interact both online and offline (such as in stores, restaurants, or hotels). If those businesses want to truly personalize their customers' experiences and maximize performance, they need to be able to tie together their offline and online data into a comprehensive customer profile.

The business requirement to unify these profiles is obvious. However, merging offline and online data can be pretty tricky. Too often, companies buy a Customer Data Platform (CDP) that says it performs identity resolution, only to find that the solution is a black box and not flexible enough to merge their key offline and online customer data.

Use this blog to avoid that pitfall: we’ll walk through the strategies you can employ to merge offline and online customer identities.

Strategy #1: Using known identifiers collected through loyalty programs

Companies with strong loyalty programs have a huge advantage in identity resolution. They typically collect phone numbers or emails during both offline and online transactions, so they can match offline to online using known identifiers. Many of our most sophisticated omnichannel retailers capture known identifiers through loyalty programs in more than 80% of their transactions.

When there are exact matches on email, phone number, or loyalty program number, identity resolution is straightforward: exact-match deterministic resolution works perfectly.

There can be challenges for these companies, however, such as:

- Customers or store associates use different emails and phone numbers across transactions

- Customers or store associates type in their email or phone numbers incorrectly

- Customers or store associates enter fake emails or phone numbers

These challenges with messy or inconsistent data require probabilistic identity resolution, since you need to bridge the gap between slightly different emails. Data cleansing can also help standardize typos. Features that detect high-frequency identifiers can help companies identify email addresses and phone numbers that get over-used by store associates, to blacklist them from their resolution algorithms.

Strategy #2: Use point-of-sale (POS) data

When companies don’t consistently collect phone numbers, email addresses, or loyalty numbers during in-store transactions, they must turn to POS data to merge profiles. Different POS systems and payment processors expose different credit card data for retailers to use, and depending on the precise payment method, e.g., physical card swipe, physical card tap, NFC wallet, or EMV chip insert, the identifiers collected can vary too. These include:

- Last four digits of credit cards

- First six digits of credit cards (i.e., BIN, or bank identifier)

- Credit card token (i.e. PAR, DPAN, MPAN, or POS token)

- Store postal code

Using credit card tokens—either network tokens or consistent vendor-generated tokens across offline and online POS systems—companies can use deterministic identity resolution to merge online and offline transactions. Relying on combinations of partial credit card numbers, postal codes, or even names requires probabilistic methods, since there can be repeated digits between different customers. Generally, we recommend starting with a deterministic graph using credit card tokens, and layering on probabilistic methods to further increase resolution.

Strategy #3: Leverage third-party identity spines to bridge the gap

For companies that lack a robust loyalty program or consistent access to credit card tokens across online and offline systems, third-party identity spines can be a powerful way to bridge the gap. Providers like Experian, Bridg (Cardlytics), and Deep Sync maintain large-scale consumer identity graphs that link together fragmented data, especially across email addresses, phone numbers, and credit card transaction data.

These vendors have access to credit bureau, financial institution, or retail partner data that allows them to link transactions using extremely sparse offline data.

This approach is especially useful when:

- You only collect partial payment data at POS (e.g., last 4 digits or BIN)

- You operate a low-friction checkout with minimal identifier capture (e.g., quick-service restaurants or CPG)

- You want to augment your existing identity graph with coverage from a broader ecosystem

To use these providers, you typically pass anonymized transaction logs, including date, store location, and partial card information, and receive back a consistent ID that can be mapped across both your online and offline data.

We recommend this approach when your internal data lacks sufficient overlap between online and offline identifiers, or when you want to enrich your existing resolution with third-party data for greater match rates. While this adds some complexity to your data flow, it can dramatically increase your ability to recognize customers across touchpoints, personalize their experience, and measure performance with precision.

Key requirements for offline-to-online identity resolution

With the strategies above in mind, let’s review the key things you should make sure your identity resolution solution accomplishes—whether you’re purchasing a packaged SaaS solution or building your own identity graph in-house.

Utilize complete customer data

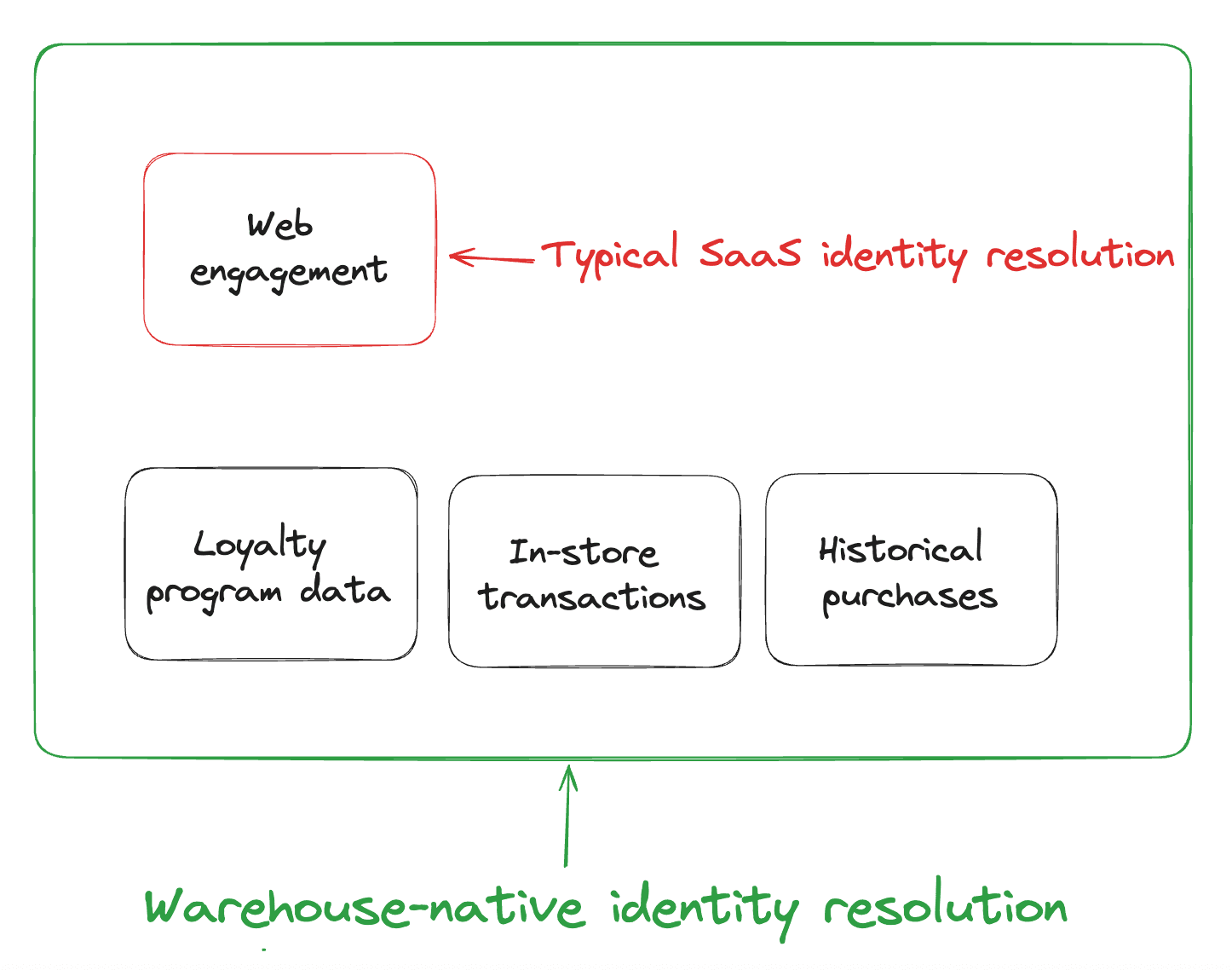

The first thing that makes or breaks an identity resolution solution is the data that it has access to. You need to be sure that your platform can incorporate customer identifiers and events from all of their offline and online interactions. Too often, identity resolution SaaS tools operate on digital clickstream events, but don’t have a reliable way to access offline data from things like point-of-sale (POS) systems or loyalty programs.

One approach to ensure acces to complete customer data is to operate entirely from a company’s data warehouse. The data warehouse is well equipped to be the central storage repository for POS data, online transactions, loyalty programs, and more.

Mix deterministic and probabilistic tactics

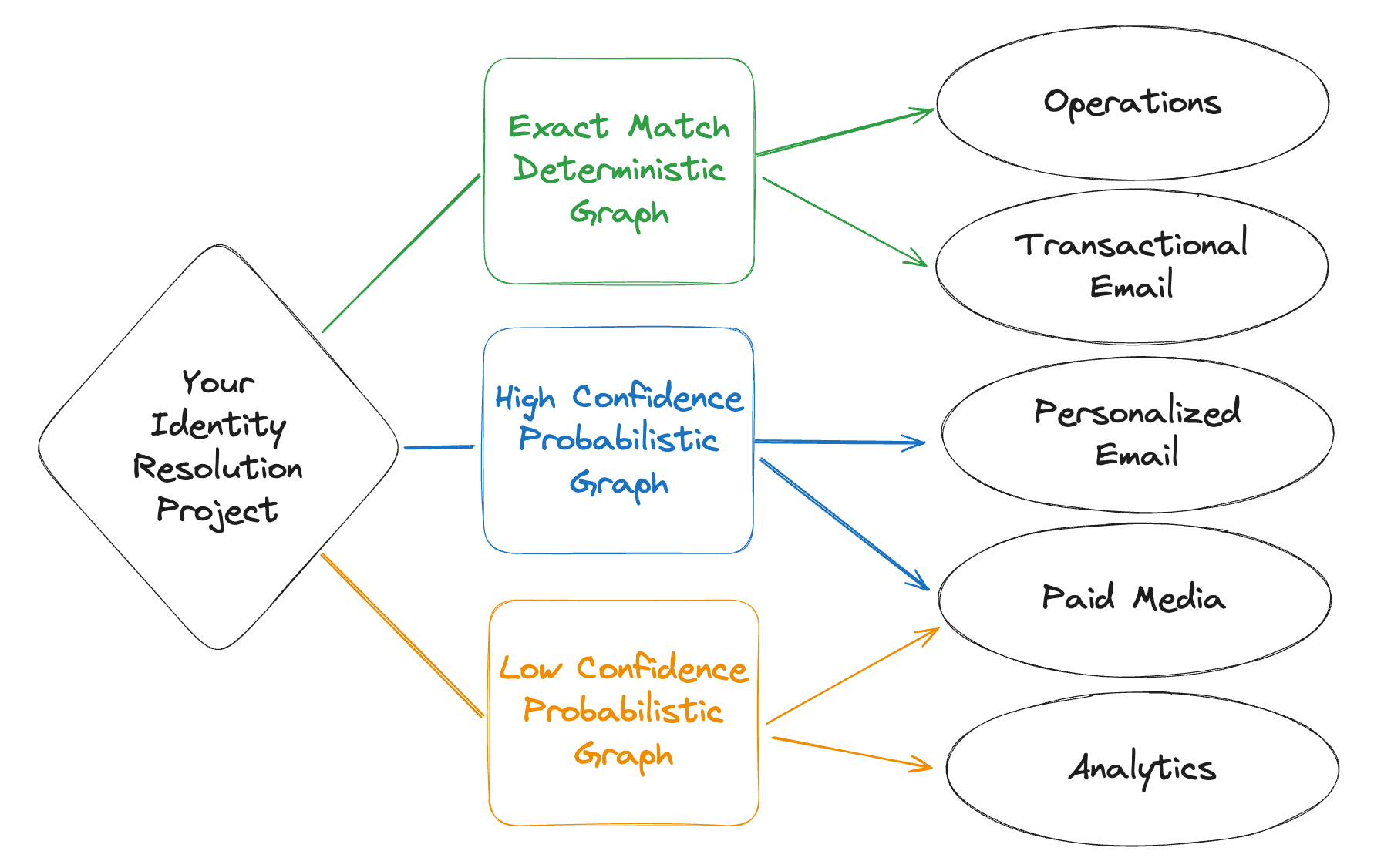

In every one of the strategies listed above, we saw that effective offline-to-online identity resolution may require deterministic (exact match) methods as well as probabilistic methods that use AI to make inferences across messier data. You should make sure your identity resolution solution allows you to leverage both strategies and layer them on top of each other, like our multi-zone approach does.

Different confidence levels of identity resolution are better suited for different use cases. Some offline-to-online matching is best served by deterministic methods, while other matches require probabilistic matching.

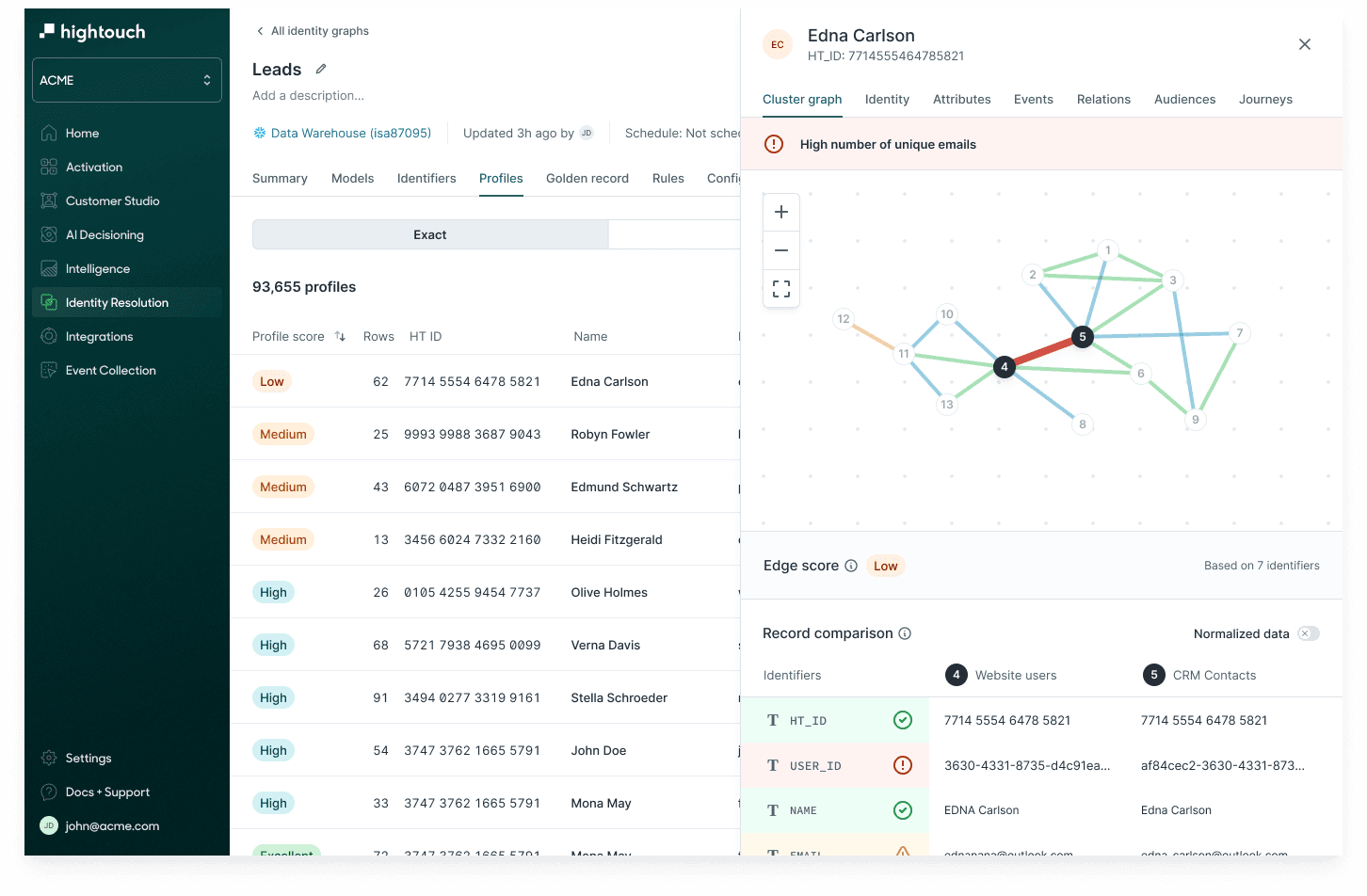

Provide transparency and configurability

Once you’ve created an identity resolution setup, how do you know it’s working? And if you are able to audit results, can you fine-tune your resolution algorithms to improve them? Ensure that you can audit your identity resolution results to check that offline-to-online merging occurs in a reasonable and logical manner, and that you can change your rules at your discretion both now and in the future.

You should pick a solution that lets you inspect and modify exactly how your profiles get merged together.

Final recommendations

You shouldn’t compromise when evaluating a solution to unify offline and online data. Whatever identity resolution provider you buy or in-house system you build, you must ensure they can actually solve this problem for your company—utilizing all of your data, mixing deterministic and probabilistic methods, and providing you with the transparency and configurability you need to fine-tune your results. Hightouch’s Adaptive Identity Resolution meets all of those requirements.

As far as making sure you have the data you need: If you don’t already have a strong loyalty program in place, this is just one example of the many benefits of loyalty programs. It’s worth exploring them for your organization!

If you do need to use POS data to unify offline and online data, making sure you have the same system in place for online and offline transactions– and that it tracks credit card tokens consistently– is an important first step to get deterministic matching in place. Then, you’ll be able to layer on probabilistic matching for other less definitive POS data.

As always, our team is happy to meet to brainstorm the best ways to solve your offline-to-online identity resolution. Please feel free to grab some time with us!